How Datacultr is Empowering South Asia’s Top Financier to Tackle Debt Collection Challenges?

Financier Overview

Our case study focuses on one of the leading NBFCs in India, that has been a mainstay in providing consumer loans, personal financing, and other credit solutions. However, with rapid growth in its customer base, the company wanted to have a cost-effective and robust system to manage operational challenges, particularly in reducing delinquencies and ensuring timely repayments among the new customers that they were onboarding from the ‘new to credit’ and thin file segment.

From Risk to Reality:

Tackling Delinquencies Head-On.

The company faced significant challenges in maintaining consistent communication with its growing customer base in this segment. Traditional communication methods like phone calls and SMSs proved ineffective in reaching borrowers, often leading to missed payments and higher delinquency rates.

Despite repeated efforts, many customers remained unresponsive, exposing inefficiencies in their traditional approach. These defaults not only drained operational resources but also significantly impacted the company’s profitability, underscoring the urgent need for a more efficient and scalable solution.

From Missed Payments to On-Time Collections:

Datacultr's Solution

To address these challenges, the leading NBFC partnered with us, to implement Datacultr. We are a risk management and digital debt collection platform known the world over for our highly impactful debt recovery strategies. By leveraging our innovative solutions, the NBFC experienced significant improvements in customer engagement, repayment rates, and overall cost efficiencies.

The Hero Feature:

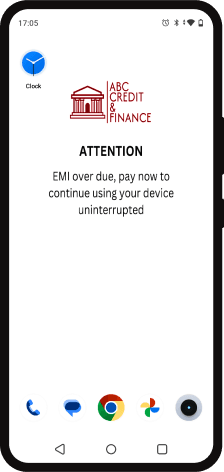

Wallpaper Lock

Datacultr’s Wallpaper Lock functionality transformed payment reminders by displaying a persistent, non-removable prompt on borrowers’ smartphone screens. This constant visual cue kept payments top-of-mind, fostering urgency and Increasing post-due collections. By eliminating reliance on manual reminders, it enhanced customer experience, making repayments more efficient and less stressful.

Number Speak:

The Happy Ending, Rather Beginning

80%

Repayment rate on the same day

Around 80% of borrowers complied with EMI payments within 24 hours of applying the wallpaper lock.

Implementation of Datacultr’s solution boasted some impressive results. The company saw a notable reduction in delinquencies, with borrowers becoming more proactive about their payments. The Wallpaper Lock not only helped improve on-time repayments but also significantly boosted customer satisfaction by offering a simple, effective, and non-intrusive solution for loan recovery.

After implementing Datacultr’s solutions, the NBFC experienced the following outcomes:

4x

Higher Collection Efficiencies

53%

Reduction in Default Rates

40-75%

Decrease in operational costs

How Were These Numbers Achieved?

High Visibility

The wallpaper reminder was impossible to ignore, ensuring borrowers were aware of their overdue payments. This constant visibility kept repayment top-of-mind, reducing the chances of missed deadlines.

Gentle Pressure

While the wallpaper lock was non-intrusive, it provided a subtle psychological nudge, creating a sense of urgency without being aggressive.

Customizable Messaging

The company had the flexibility to personalize the wallpaper messages, including deadlines, outstanding amounts, and direct links to payment portals. This customization made the repayment process more convenient.

Here’s a little appreciation snippet from them!

“With Datacultr, we could offer our customers, an effective yet empathetic solution to the traditional loan repayment approach. Going digital with datacultr workflows has helped us improve our reach and reduce our delinquencies. We have integrated the Wallpaper Lock feature as a permanent feature in our customer journey. Just like the entire Datacultr platform”