Promise Kept, Success Delivered:

Inside an NBFC’s

Journey with Datacultr's

Promise To Pay

Client Overview

One of India’s premier banking and financial services groups, known for its wide range of offering across retail, corporate, and investment banking, wanted to optimize its growing lending portfolio. With rapid expansion in personal loans, two-wheeler financing, and consumer durable loans, the company was facing increasing pressure to streamline collections, all while reducing borrower friction and minimizing operational overhead.

The Challenge:

While customer acquisition had gone digital, with seamless onboarding through apps and online platforms, the collection process remained largely traditional. Manual follow-ups, repetitive phone calls, and generic reminders continued to dominate, creating a mismatch between how customers entered the system and how repayments were pursued.

The Core Challenges Included:

Low Engagement Rates

Only 20% of borrowers answered collection calls.

Low Commitment Levels

Among those who did respond, just 12% verbally committed to making a payment.

Poor Conversion

Only 5% of those who committed actually followed through.

These inefficiencies not only drove up operational costs but also caused delays in repayment cycles, a growing

concern in today’s fast-paced and highly competitive lending environment.

Datacultr’s Solution:

Promise To Pay (PTP)

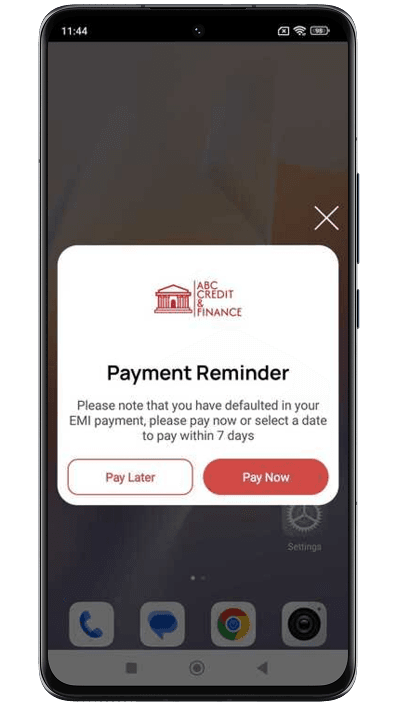

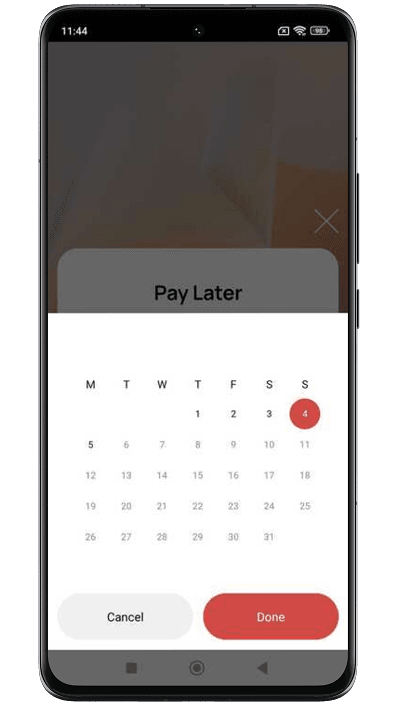

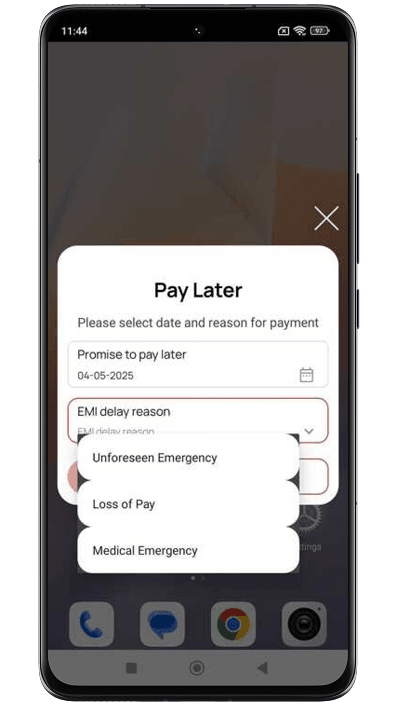

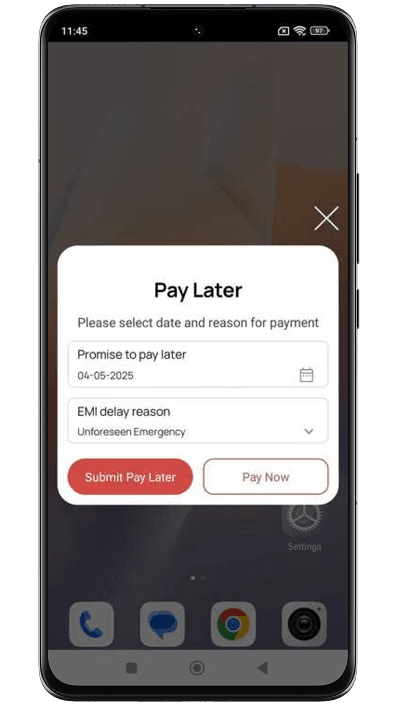

To overcome these challenges, the company turned to Datacultr’s Promise To Pay (PTP), a smart, digital strategy designed to secure clear and time-bound payment commitments from borrowers, without depending on phone calls or manual follow-ups.

By delivering personalized, high-impact messages directly to borrowers’ devices, the PTP cut through communication barriers and created a sense of ownership and urgency around repayment. This digital engagement approach allowed the company to operate at a large scale while driving higher commitment rates and reducing operational load.

Key Impact:

Picture a borrower who’s either delinquent or at high risk of default. His payment is due, but he hasn’t responded to calls, and the ‘payment due’ messages are lying unopened in his inbox. The reality? He may be unable to pay, not because he’s unwilling; but because he’s currently facing a financial crunch. In such a situation, empathy becomes as critical as efficiency. The challenge is to engage him meaningfully, understand his situation, and get a clear, time-bound promise to repay.

This is where Datacultr’s Promise to Pay (PTP) solution delivered results. Through Datacultr’s platform, PTP were administered directly to borrowers’ smartphones – delivering timely, personalized, and branded messages that cut through the noise of spam and built trust and familiarity. The aim was simple yet powerful: securing a genuine commitment to pay on a specific date.

Results & Outcomes:

01

12X Improvement in Conversion

Over 80–85% of borrowers engaged during the PTP window made a promise to pay. Of those, 60–65% followed through on their commitment, an exponential increase compared to the 5% success rate for traditional methods.

02

70% Reduction in Operational Costs

By shifting from manpower-heavy follow-ups to digital-first outreach, the company achieved a 70% reduction in operational costs.

Why PTP Worked For The NBFC?

The Promise to Pay feature transformed post-due collections for the NBFC. Instead of chasing borrowers through unreliable channels, they joined the 100% Club. This resulted in:

100% Right-Party Contact

Achieving 100% Right-Party Contact (RPC) by directly engaging with borrowers on their devices.

100% Actionability

Ensuring 100% actionability by building accountability through specific, time-bound commitments

100% Delivery

Securing 100% delivery leading to accelerated repayments and improved efficiency at scale.

Success Stories

“With PTP, we stopped chasing borrowers and started getting real commitments. Instead of relying on endless calls and unanswered messages, we now engage borrowers directly on their devices, at the right time, in their language of choice, with the right message. It’s helped us build trust, drive accountability, and most importantly—turn intentions into actual payments.”